Digital Records of Physical Assets for Investment

For liquidity providers, that suffer with de-risking asset investments,

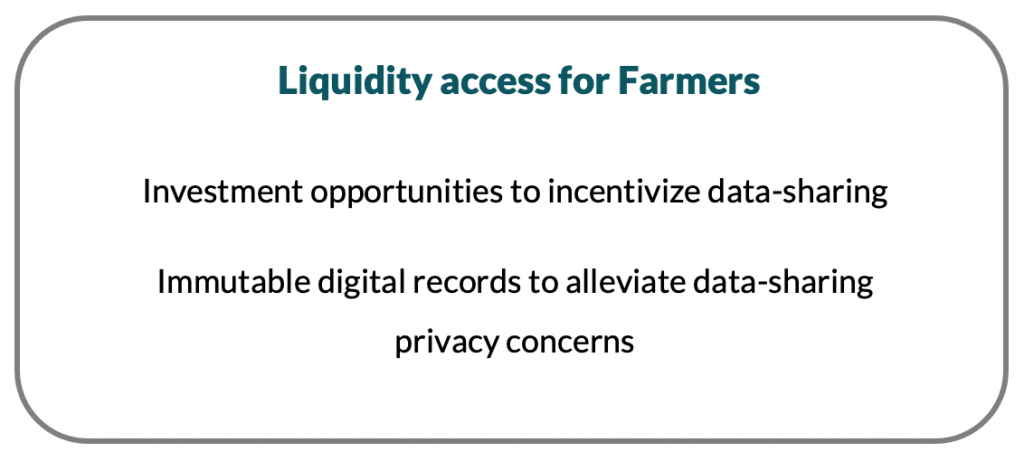

For Agri-cooperatives, that suffer with privacy concerns,

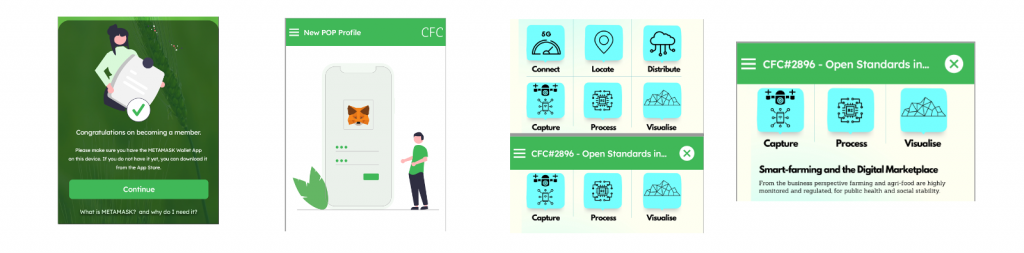

we offer a mobile wallet application that provides digital records of physical assets.

Unlike other smart farming applications, our product is a marketspace of immutable assets for investment opportunities, targeting DeFi platforms.

To use the platform, customers are charged based on the amount of segmented or sorted data they want to use or with a subscription for an unlimited amount of data.

- Visualising the data on the UI is free; downloading data or downloading visualised data (maps, tables etc) has a cost

- Input suppliers would pay to have access to farmers and distributors data for best practices

- Retailers would pay to better understand the consumers purchasing habits

- certification fees

- other more complex pricing models (e.g., training and consultancy, workshop fees and sponsorships

- customer growth: government and other non-profit funding organizations, as well as other verticals that need Net Zero emission compliance

PRODUCT FEATURES

-

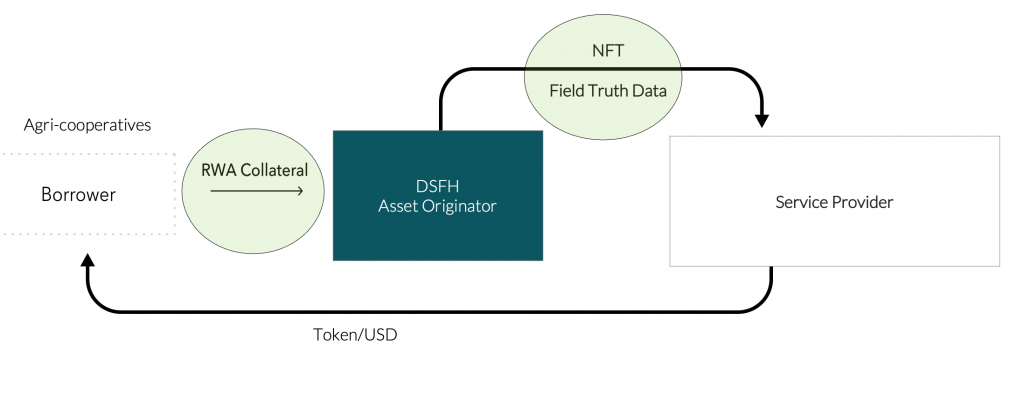

Farmers and fieldworkers use our App to collect data and compile farm-habitat assessments of their physical assets.

-

Assessments are converted into traceable digital records by our platform and stored in a user’s native wallet

-

Our marketspace platform uses these digital records to engage providers for fundraising and accredited services

-

Members can access our platform to view data for how funds are being used to support endeavours

-

Members contribute and vote on community decisions to improve habitat assessment metrics/best practices

BENEFITS

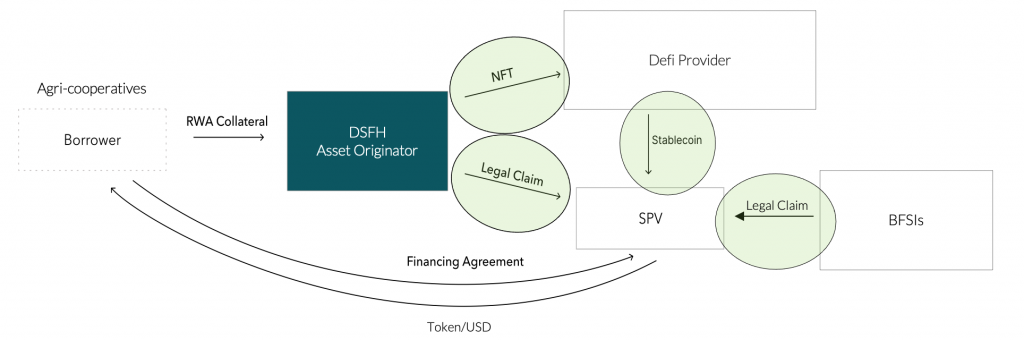

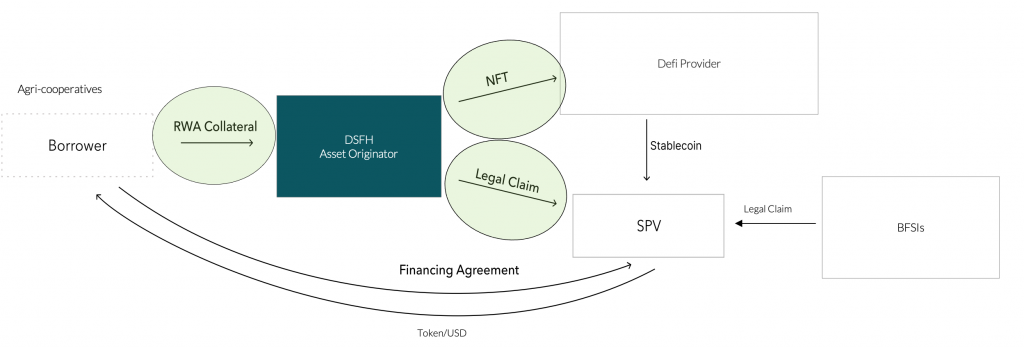

1. Standardised financial institutions (SPVs) compliance for DeFi investors

- regulations that DeFi platforms must comply with to be onboarded by traditional banking, financial services and insurances (BFSIs) organizations.

- SPV can help to isolate the parent company from financial risk by separating the assets and liabilities of the SPV from those of the parent company.

- allow investors to buy securities that are backed by specific assets rather than the creditworthiness of the parent company.

2. Transparent Net Zero provenance metrics for value chain investors

- proof-of-existence (POE)

- transparent practice

- data provenance

- proof-of-origin and geolocation

- freshness/time-to-market

- produce safety and integrity

- non-exploitation/sustainability credentials

- climate-aware services: compensation and neutralisation projects

3. Optional: Net Zero provenance data for value chain service providers to build products

.

ADVANTAGES

–