We make peer-to-peer investing a more viable option to address biodiversity decline based on NetZero compliance.

Compliance · the action or fact of complying with a wish or command

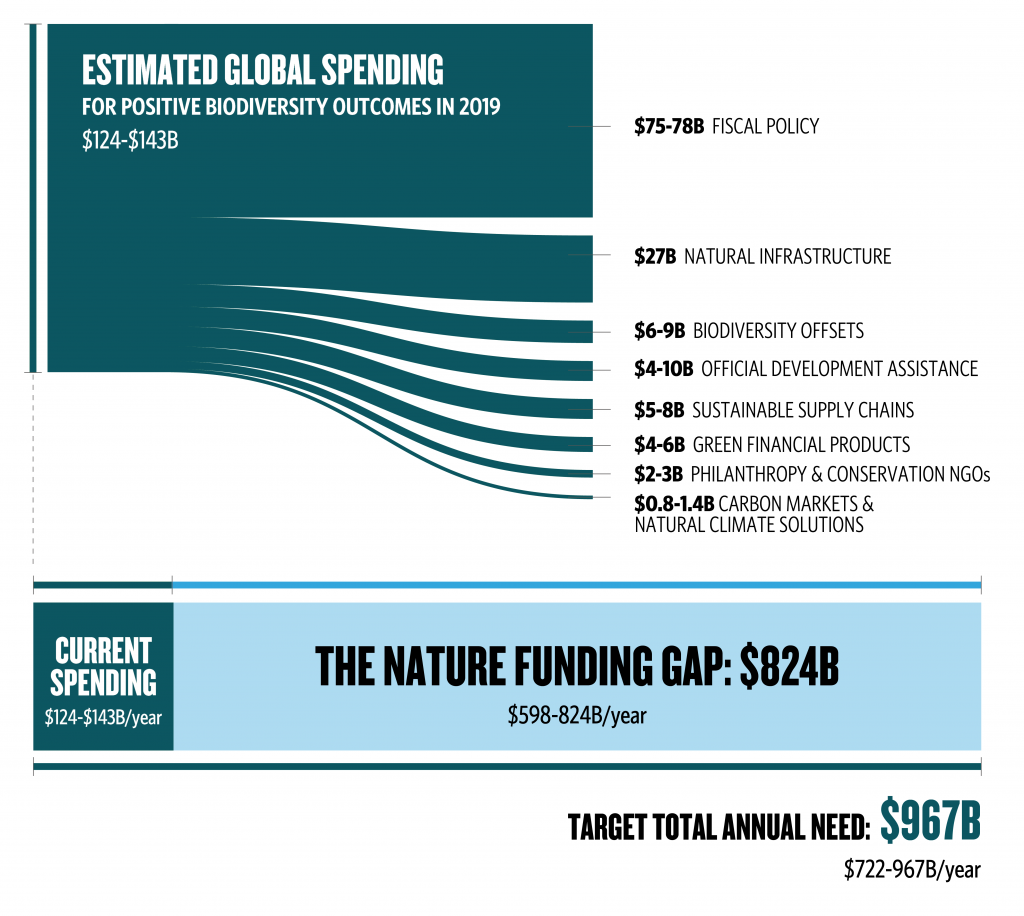

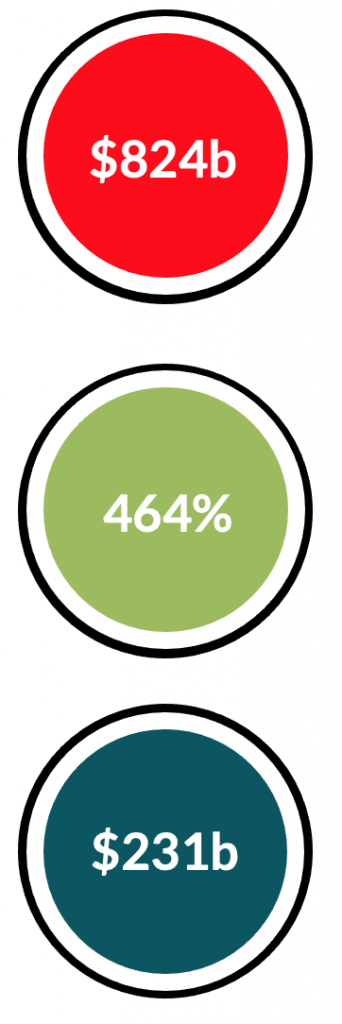

$824 billion is how much money we need by 2030 to overcome global biodiversity decline (World Economic Forum, 2023), which is a lot of opportunities to invest in assets driven by NetZero compliance needs.

And with a 464% increased in crypto asset investments since 2020, reducing the friction to raise money from these investors seems a no brainer (Fidelity Charitable, 2021).

Especially when the crypto finance market size is expected to reach $231 billion by 2030 (Grand View Research, 2023).

Equitable · recognising that we do not all start from the same place and must acknowledge and make adjustments to imbalances

COMPLIANCE MADE EQUITABLE

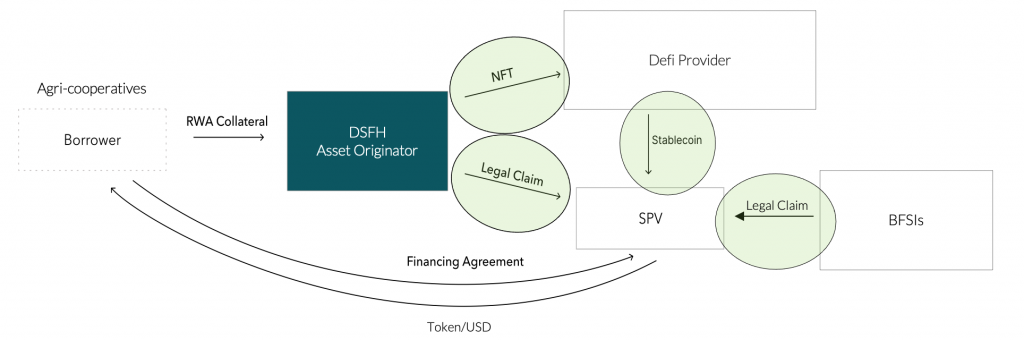

For liquidity providers, that suffer with de-risking asset investments,

For Agri-cooperatives, that suffer with privacy concerns,

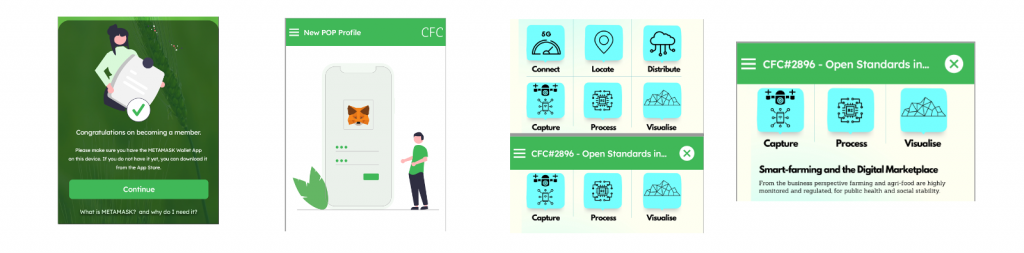

we offer a mobile wallet application that provides digital records of physical assets.

Unlike other smart farming applications, our product is a marketspace of immutable assets for investment opportunities, targeting DeFi platforms.

PRODUCT FEATURES

-

Farmers and fieldworkers use our App to collect data and compile farm-habitat assessments of their physical assets.

-

Assessments are converted into traceable digital records by our platform and stored in a user’s native wallet

-

Our marketspace platform uses these digital records to engage providers for fundraising and accredited services

-

Members can access our platform to view data for how funds are being used to support endeavours

-

Members contribute and vote on community decisions to improve habitat assessment metrics/best practices

.

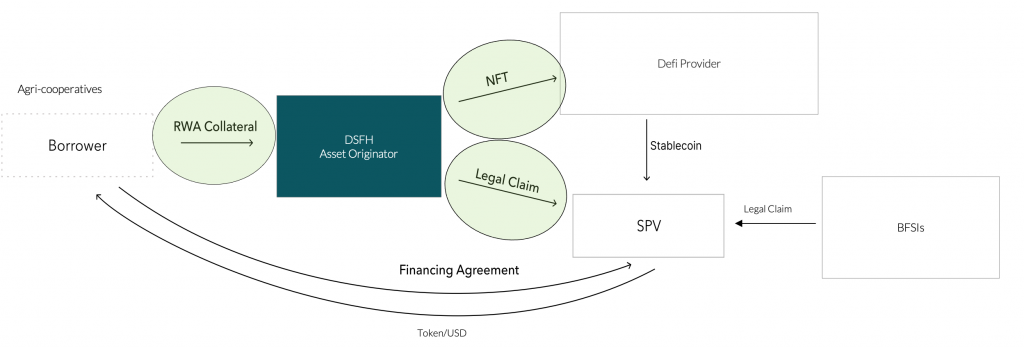

1. We smooth the way for DeFi Platforms to comply with traditional investment standards

Standardised financial institutions (SPVs) compliance for DeFi investors

2. We make it easier for banks to comply with the desire of investors to see how their money is being spent and the impact it is having.

Transparent Net Zero provenance metrics for value chain investors

- proof-of-existence (POE)

- transparent practice

- data provenance

- proof-of-origin and geolocation

- freshness/time-to-market

- produce safety and integrity

- non-exploitation/sustainability credentials

- climate-aware services: compensation and neutralisation projects

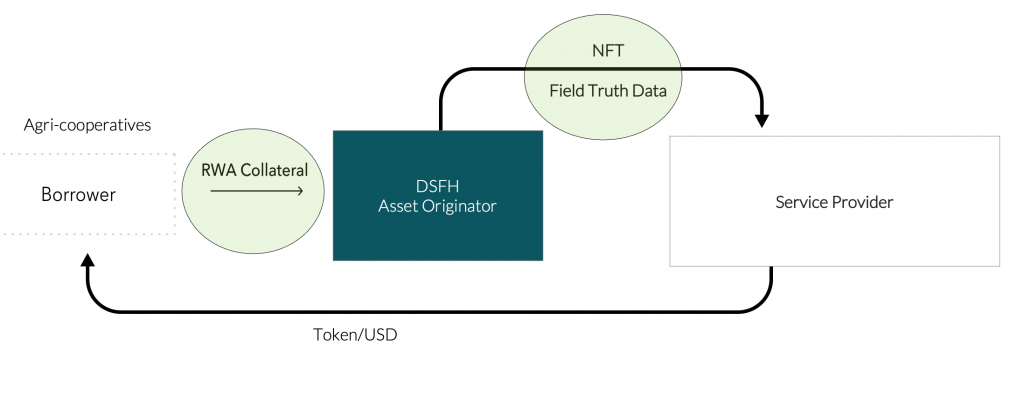

3. As well as open the door for input providers to comply with farmer’s needs for privacy when sharing their data and to compensate them for that data.

Optional: Net Zero provenance data for value chain service providers to build products